Sage Intacct is the only preferred provider of the AIPCA for cloud financial management and is specialized in helping Wealth and Asset Management firms, REITs, and Family Offices. Sage Intacct streamlines investments, capital, and claims reporting, all while delivering real-time visibility into the metrics that matter. With Sage Intacct for wealth and asset management, you can easily scale for growth and effectively manage multiple locations, funding streams, and entities. Our modern, native-cloud solution, with open API architecture, gives Wealth and Asset Management firms the connectivity, visibility, and efficiency they need to do more with less.

Benefits.

Want to learn how to digitally transform wealth and asset management? Chat with us

Downloadable Resources

|

|

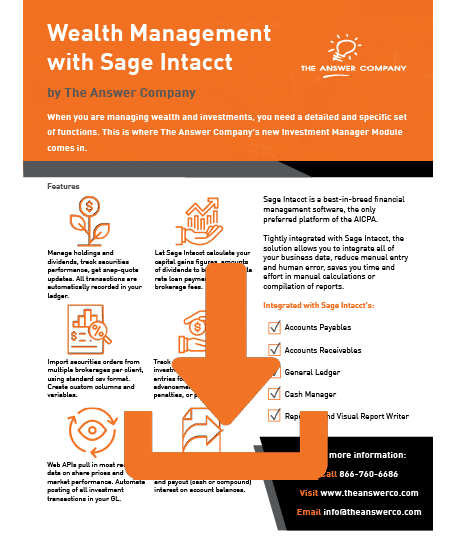

Wealth Management With Sage Intacct |

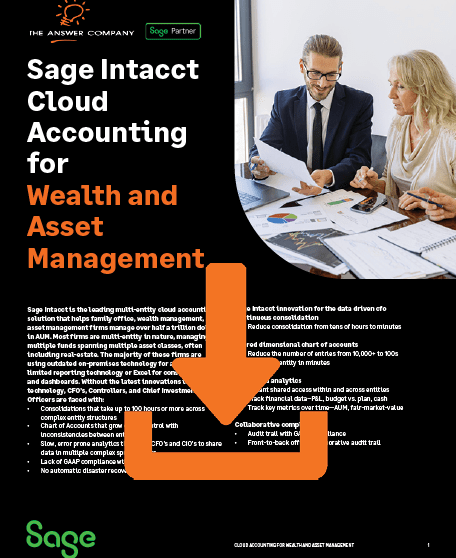

Cloud Accounting for Wealth and Asset Management |

|

Why Wealth and Asset Management Firms are Choosing Sage Intacct Accounting Software

Industry Recognition and User Reviews

Sage Intacct is the only accounting software preferred by the AICPA. Based on over 1000 credible G2 reviews, Sage Intacct is in G2’s Leader Quadrant and holds the Top Customer Satisfaction Rating. The solution is rated 8.7 out of 10 on TrustRadius and 4.4 out of 5 on Gartner Peer Insights. Read more Sage Intacct reviews.

Open API Structure

On top of several native integrations, Sage Intacct’s open architecture allows for easy and seamless integration with hundreds of third-party applications, requiring very little additional developer work. Many Sage Intacct users favour the solution for its easy connection with CriterionHCM, Tipalti, and countless others.

Return on Investment

Across various industries and organization sizes, Sage Intacct has proven an average return on investment (ROI) of 250% with a less than 6-month payback period.

Meet a Team Member

Meet Shawn Ostheimer, Our Sage Intacct for Family Office/Wealth and Asset Management Expert

Shawn Ostheimer is the founder and president of The Answer Company. Beginning in 1994, Shawn has spearheaded the company’s growth to become the largest Sage provider in Western Canada. With...

-

How to Future-Proof your Business in the Wealth and Asset…

The financial services landscape has experienced an…

-

10 Things You Need To Know About ERP Implementation

ERP systems permeate virtually every operational aspect of…

-

Considering Hiring an ERP Consultant?

Implementing new projects and programs can be a daunting…

-

Critical Metrics your Financial Dashboards Should Have

As a CFO, it’s your responsibility to utilize data to make…