If you’re managing finance across multiple companies or business units, you know the strain. Month-end drags. Reconciliation takes longer than it should. And intercompany entries? A headache every time.

This is multi-entity and intercompany accounting in real life. And if your ERP wasn’t designed to handle it, the pain only grows as you scale.

Finance leaders are under more pressure than ever to deliver faster insights, manage risk, and enable growth — all while doing more with fewer resources. The margin for error is shrinking. Audit expectations are rising. And you need real-time visibility, not reports that arrive a week after month-end.

It doesn’t have to be this hard.

What Makes Multi-Entity Accounting So Difficult?

Let’s be honest:

Most mid-market ERPs weren’t built for businesses managing multiple entities. The workarounds are everywhere. And your team is paying the price.

At The Answer Company, we’ve led thousands of digital transformations, and this is one of the most common pain points we encounter.

Whether it’s a regional distributor with six entities or a professional services firm managing intercompany billing across projects, the symptoms are the same: overworked finance teams stuck compensating for systems that weren’t designed to scale.

Top 5 Challenges We Hear from CFOs and Finance Directors:

Too Many Spreadsheets, Too Little Confidence

Without built-in consolidation tools, your team spends days manually rolling up financials. The process is fragile, prone to errors, and hard to audit.

Siloed Visibility

Switching between systems (or worse, logins) to see what’s happening across entities? That’s a visibility gap you can’t afford, especially during audits, board reviews, or strategic planning.

Intercompany Transactions That Never Line Up

Whether you’re allocating shared expenses, recording internal sales, or moving inventory between entities, the entries rarely match up. And reconciling them steals valuable hours from your month-end close.

Risk Amplified

Without audit trails and automated eliminations, compliance becomes a very manual effort. That opens you up to delays, missed filings, or worse.

Growth Without Scalability

Adding a new entity shouldn’t require hiring another accountant. But in most systems, it does. That’s not scalable, and it’s not sustainable.

What to Look for in a Multi-Entity ERP

If you’re evaluating ERP options for intercompany accounting, here are the must-haves:

- Centralized Management: One login, one platform—no toggling between systems.

- Automated Intercompany Entries: Eliminate double entry with mirrored transactions.

- Built-In Consolidations: Real-time rollups with no manual spreadsheets.

- Scalable Structure: Add new entities in minutes, not months.

- Audit-Ready Logs: Every transaction time-stamped and traceable.

Acumatica checks all these boxes, and more. But getting the most from your ERP starts with choosing the right partner to guide your setup.

Multi-entity finance doesn’t just need automation. It needs clarity. Acumatica gives you both. We’ve helped clients consolidate faster, stay audit-ready, and spend more time on strategy — not spreadsheets.

How Acumatica Simplifies Multi-Entity and Intercompany Accounting

Acumatica Cloud ERP is different. It’s a modern cloud ERP designed to handle financial complexity. It scales with your business, without adding headcount or chaos.

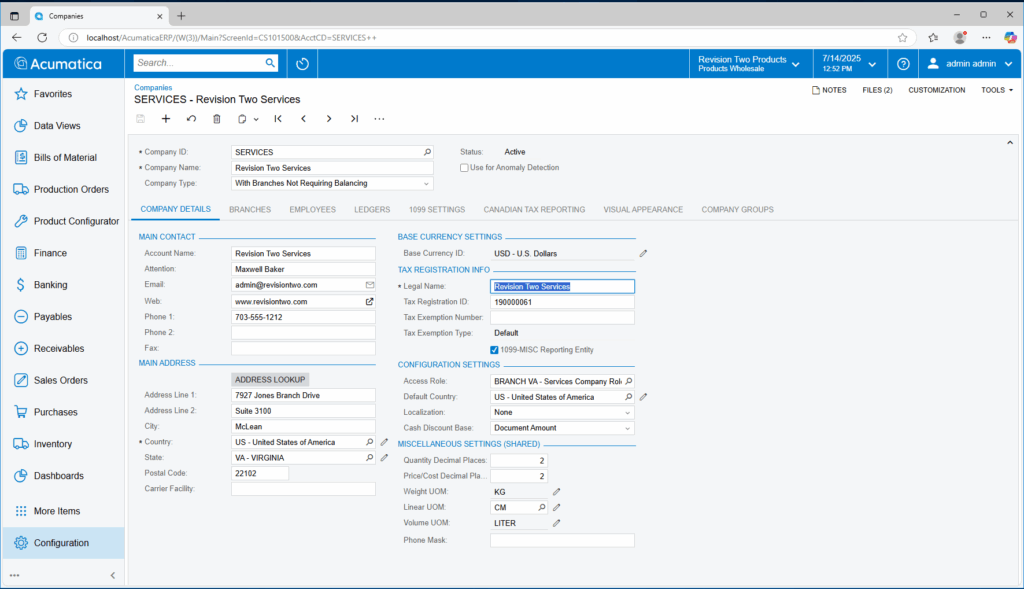

Handle every company, division, or legal entity in a single system. No extra licenses, no separate databases, no mess.

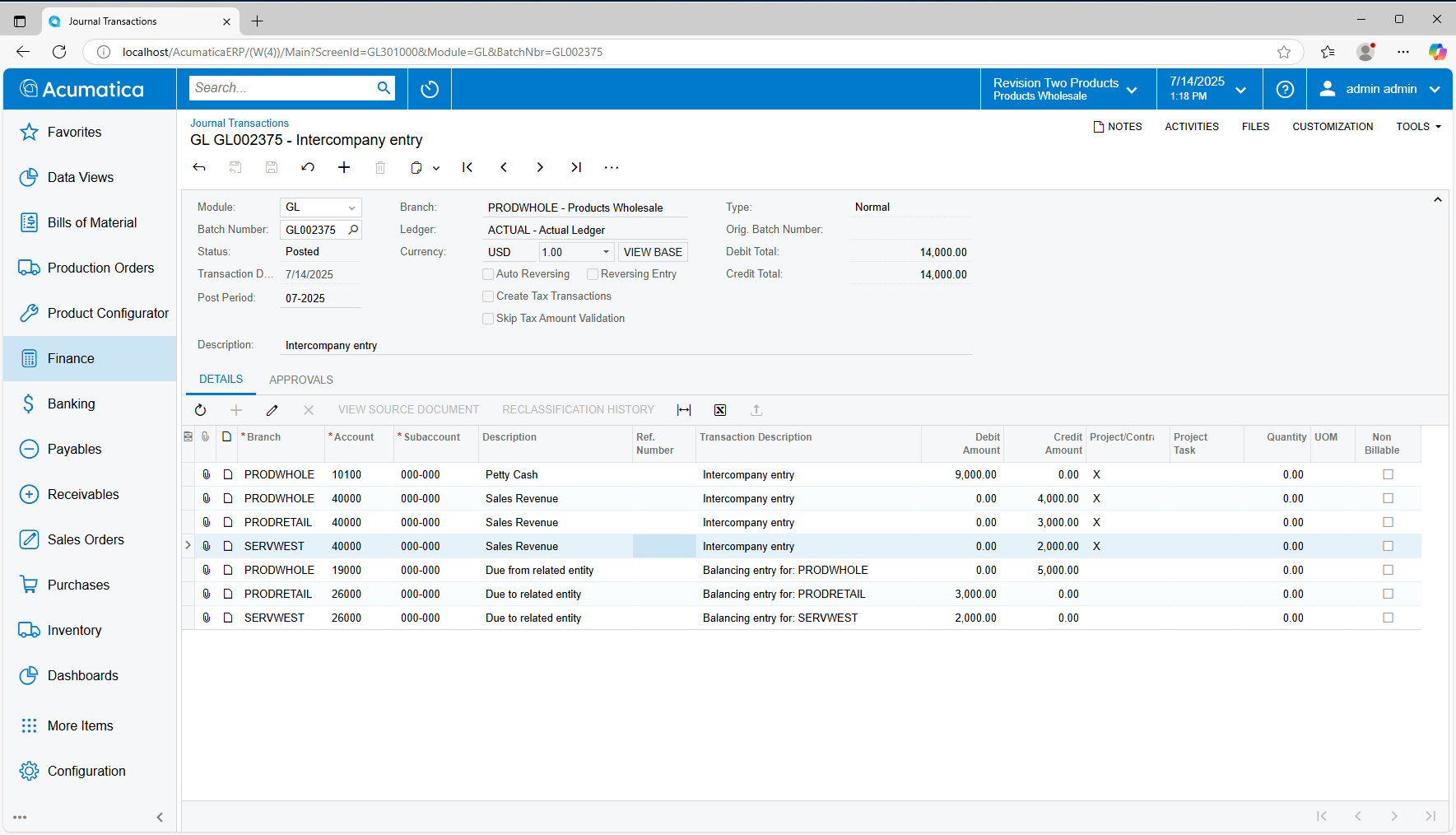

Post once and let Acumatica handle the mirrored intercompany transaction—automatically balanced and audit-ready.

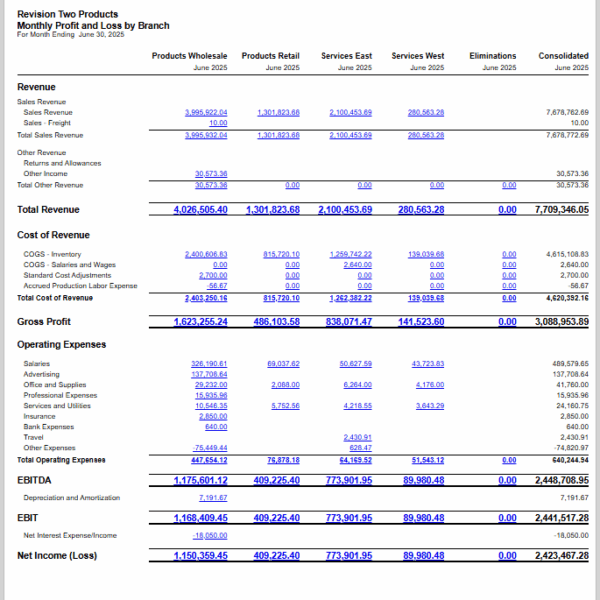

Get a real-time view of financial performance across all entities, with drill-down capabilities built in.

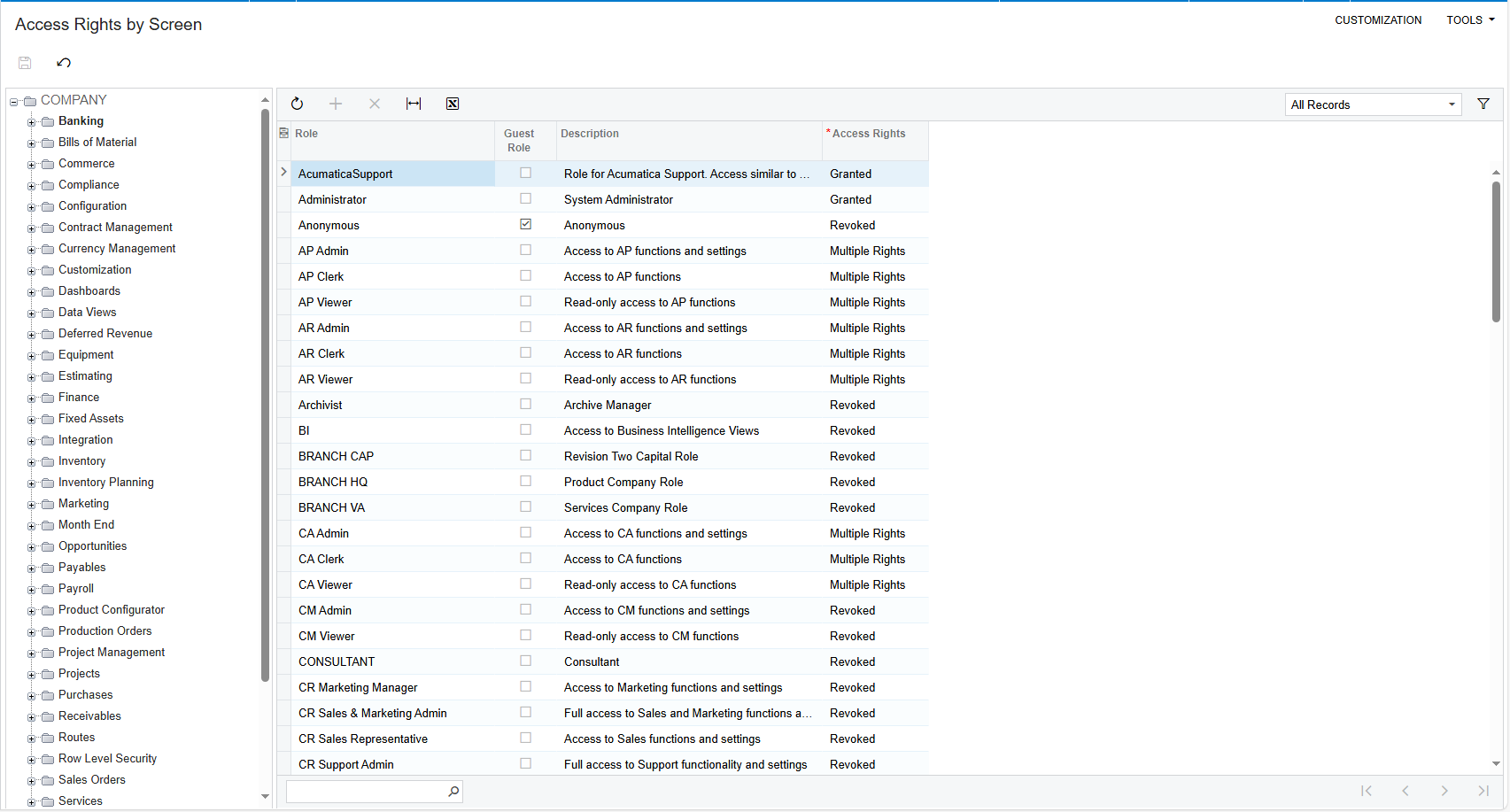

Assign access and workflows by entity, department, or role—keeping governance tight and operations flexible.

Assign access and workflows by entity, department, or role—keeping governance tight and operations flexible.

Every transaction is tracked and time-stamped for full audit readiness and accountability.

Customer Success Story

North American Home Finance Save 500+ hours a year on multi-entity and intercompany consolidations

From 10+ hours of intercompany headaches to 1-click consolidated reporting, see how North America Home Finance simplified everything with Acumatica.

Before Acumatica

4 entities, 3 systems

and countless spreadsheets

10+ hours monthly

reconciling intercompany billing

8 hours a week

reconciling bank and other disparate systems

After Acumatica

One unified

cloud-based system

Auto-mirrored

intercompany transactions

Bank feeds

in one place

1-click

consolidated reporting

Acumatica + Velixo

seamlessly reporting across all entities

45 hours a month

saved with automated consolidations

FAQ: Multi-Entity ERP & Intercompany Accounting

It’s the ability to manage financials across multiple companies or legal entities within a single system. Acumatica supports billing, allocations, eliminations, and consolidated reporting.

Once you post a transaction in one entity, Acumatica automatically creates the corresponding entry in the related entity, saving time and reducing errors.

Absolutely. Consolidations are built-in and update in real time. No need to export data or build reports manually.

Audit prep gets dramatically easier with Acumatica. Every transaction, including intercompany entries. is fully traceable with time-stamped audit trails. You can quickly filter, export, and share supporting data with external auditors without scrambling through spreadsheets or chasing down records across entities. Plus, real-time visibility means you can catch discrepancies before they become audit flags.

Yes, Acumatica provides granular role-based access controls that let you manage who sees what, by entity, module, or even specific transaction type. This means regional finance teams can manage their own books while HQ retains oversight, or business unit leaders can track performance without accessing sensitive corporate data. It’s flexible, secure, and built for growth.

There’s no technical limit. Whether you manage 3 or 30 entities, Acumatica scales with you, without extra user fees.Yes. We focus exclusively on Acumatica Cloud ERP, giving us deep expertise in its capabilities, integrations, and customization potential. This focus helps us deliver more precise, efficient, and scalable solutions across industries.

Acumatica allows you to define intercompany relationships and rules upfront, so when transactions occur between entities, like shared expenses or internal sales, the system automatically creates the balancing entries and flags them for elimination during consolidation. This means no more duplicating data in spreadsheets or manually reversing entries at month-end. It’s built-in, not bolted on.

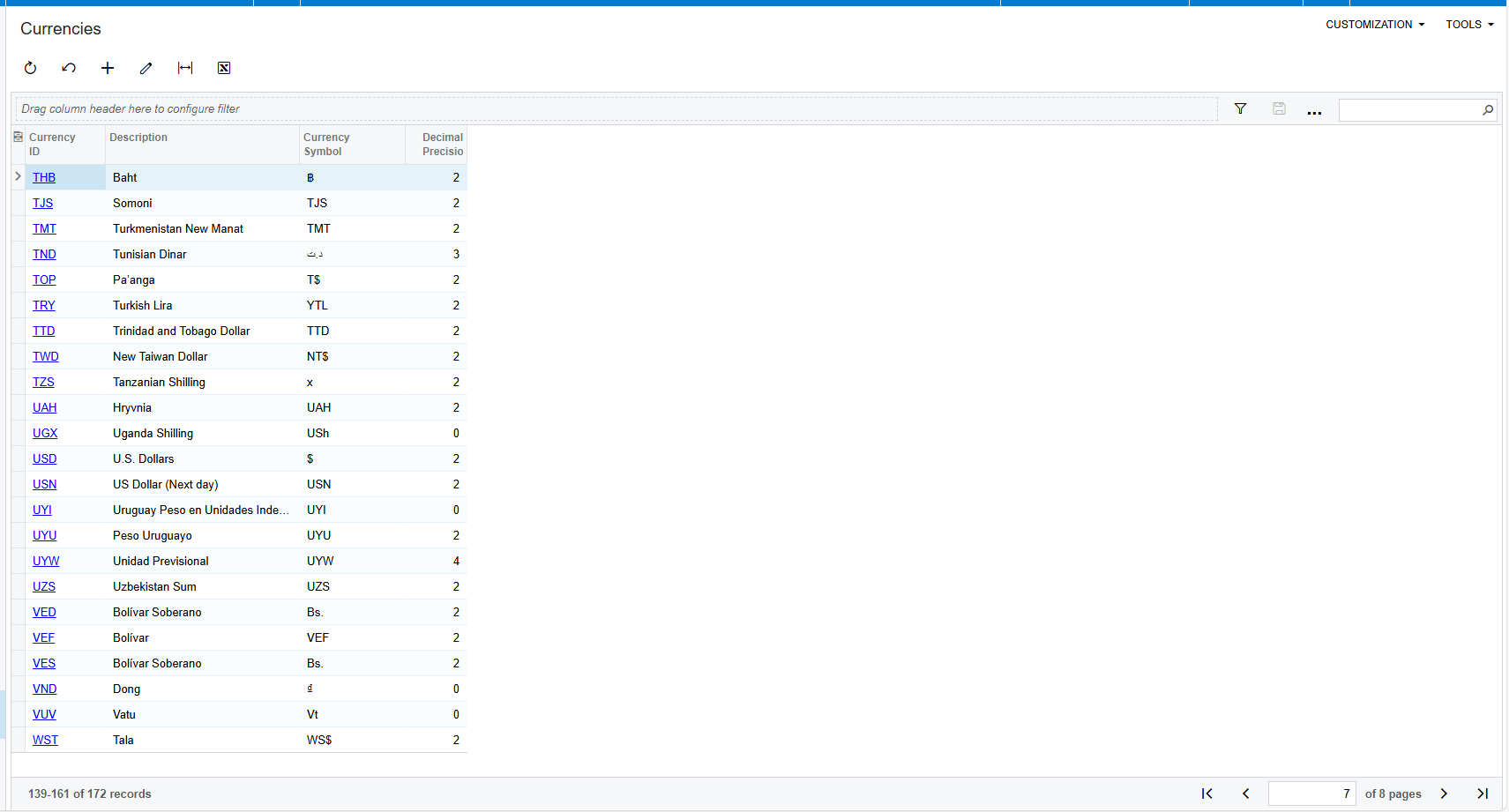

Yes. Acumatica’s multi-currency and localization features support global financial management. You can roll up financials across subsidiaries operating in different currencies, with automatic currency conversions based on daily rates. Country-specific tax codes and regulations are also supported, helping you stay compliant without extra customization.

You get access to real-time dashboards and financial reports that show consolidated views, or drill down into specific entities. Whether you need a group P&L, entity-level balance sheet, or intercompany reconciliation report, Acumatica makes it easy to customize and share insights across your leadership team. The data is always current, so decisions are always informed.

It depends on complexity: the number of entities, integrations, and custom workflows, but most mid-sized organizations go live in 6-9 months with the right partner. At The Answer Company, we’ve led hundreds of multi-entity implementations. We use a proven methodology that streamlines setup while ensuring your finance team has the tools, training, and confidence to own the system from day one.