Built for Professional Services, Powered by Innovation

Your partner in driving project success and client satisfaction.

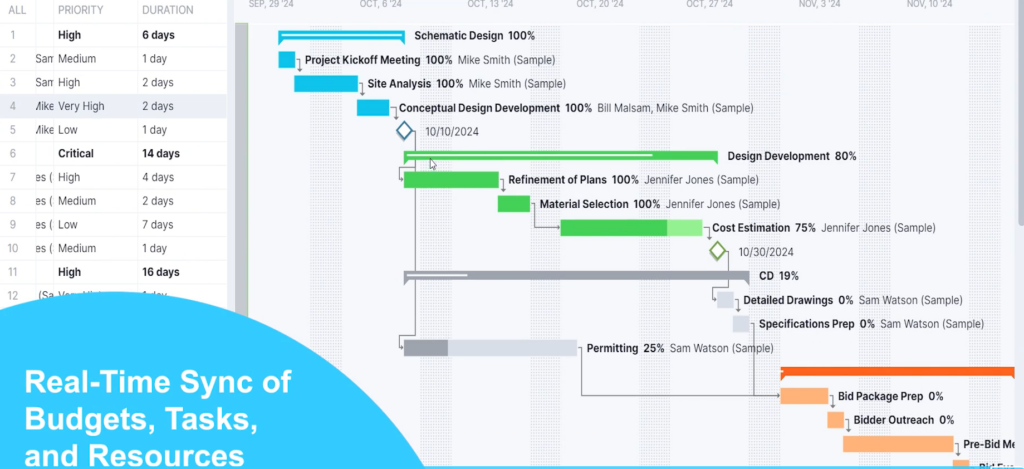

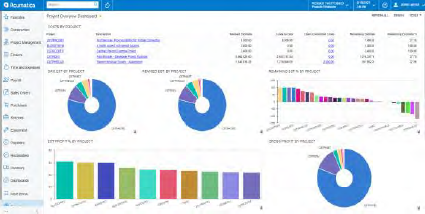

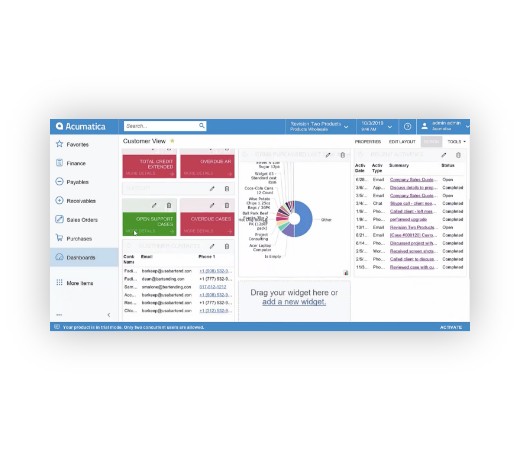

Managing complex projects while maintaining profitability can be daunting. Acumatica Professional Services Software is designed to simplify project oversight, enhance team productivity, and deliver actionable insights—all while keeping client relationships at the forefront.

Supporting your Success: Our Experience, Your Advantage

As a professional services organization ourselves, The Answer Company understands the unique challenges you face. We’ve built our reputation on empowering businesses like yours, leveraging Acumatica’s modern, cloud-based ERP to streamline our own operations and enhance client outcomes. We run our own business using Acumatica and our hands-on experience ensures we don’t just recommend the solution—we live it, tailoring it to align with your needs and deliver tangible results.

With over two decades of expertise, we’ve helped countless firms like yours achieve efficiency, scalability, and profitability. Whether optimizing project management, automating resource allocation, or providing deep financial insights, our team combines Acumatica’s technology with our industry knowledge to propel your business forward.