Managing Business Risk in the Food and Beverage Industry

Most started out as one-person or family operations years ago and have grown into sophisticated vertically integrated enterprises offering one-stop niche brands, solutions, and services. Some are cooperatives representing hundreds or thousands of small members who harvest fruits, vegetables, nuts, grains, coffee, tea, water, meats, or fish. Others are successful producers, processors, or distributors that have grown into sizable businesses in their own right.

Cooperatives—along with larger processor and wholesaler businesses—have taken on the role of overseeing the processing, storing, and distributing of goods as well as the marketing and customer relationships. They are responsible for long-term strategies, marketing contracts, operational improvements, regulatory compliance, capital expenditures, acquisitions, and pricing strategies. As companies expand into new markets, they must meet additional regulations and serve more demanding customers. This puts their ability to maintain profitability (and increase pay prices in the case of co-ops) at risk. The greatest risks to this industry are:

- Innovating new products, packaging, and application solutions to reach new markets without taking on more than they can effectively manage

- Reliably, efficiently, and profitably delivering the freshest and highest quality products on a consistent basis to a multinational customer base

- Achieving and maintaining full compliance of government and industry regulations for food, environment, and worker safety in the U.S. and abroad

This industry has relied on a mix of manual, industry-developed, and financial systems to run their operations. However, they have since evolved into vertically integrated supply chains, multinational import and export channels, and complex businesses providing food solutions. Without a cohesive enterprise wide system that integrates and oversees all aspects of their operations, these companies will struggle to quickly identify and resolve problems impacting customer service, sales performance, mandated compliance, or their financial positions.

One-Stop Solutions for Category Leadership

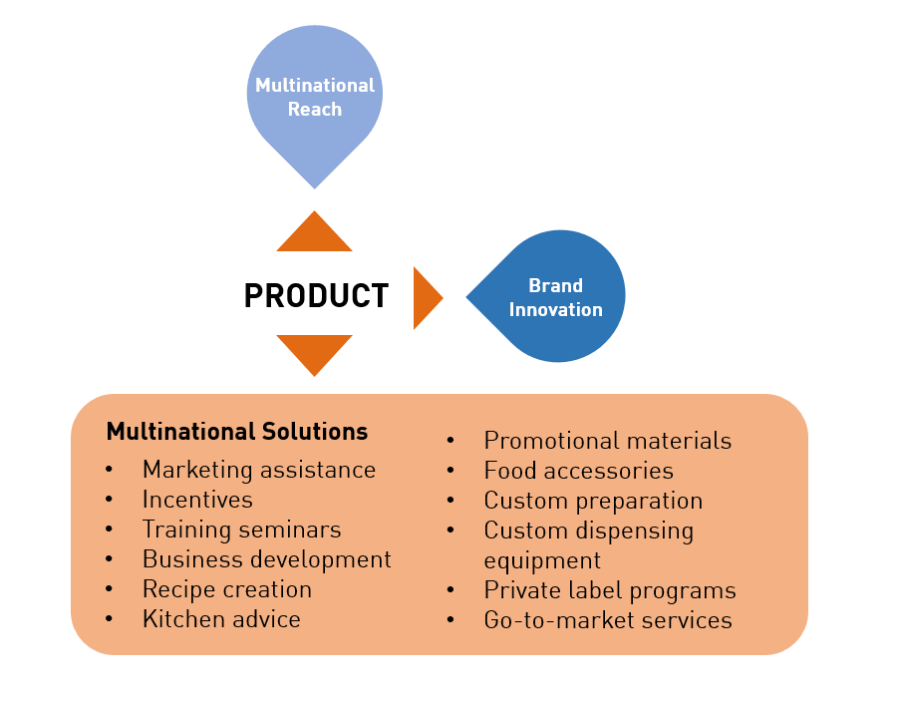

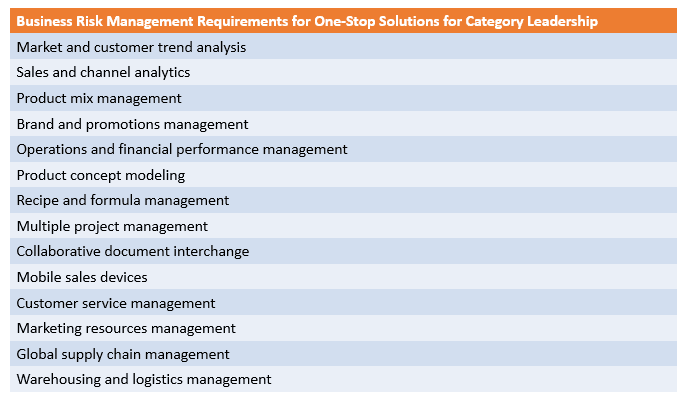

The business of selling whole or minimally processed foods and beverages is no longer just about the product. It’s now about how to leverage flagship products into full-service niche leadership. To be a category market leader today, companies are competing on brand innovation, customer solutions, and multinational reach.

Leadership growth hasn’t been limited to new products or product variations. Many companies have moved quickly into new markets and are building direct relationships with consumers on the Internet and strategic partnerships with star chefs, food service chains, mass merchants, top vending suppliers and leading retailers, restaurants, and hotels. They are looking at ways to offer solutions at a time when consumers and food preparers want greater convenience, ease of preparation, and higher quality results. The challenge is adding more variety, channels, and applications into a supply chain designed for high volumes, low mix, and fixed continuous processes. As they chase opportunities and expand in multiple directions (see Figure 1), they risk losing control of costs and customer satisfaction as well as spreading themselves too thin.

Brand Innovation:

To compete, midsize companies across the industry have stepped up research and development (R&D) to improve on and leverage existing brands and product lines for new applications, markets, and regions. The way people eat and what they eat around the globe continually changes, and this is driving co-ops and processors to research and develop new types of packaging, a wider variety of flavors, partially prepared options, and facilities dedicated to organic, allergy-free, or kosher foods. To support these shifts, companies are building or expanding facilities with state-of-the-art technologies and systems for development, testing, processing, and packaging.

Their sizable investments may not deliver a healthy return for companies that miscalculate consumer trends, product mix demand, or the high cost of marketing. Leaders in the industry recognize this threat and are beefing up their information systems to gain greater insight into channel and market trends and improve communication among sales, marketing, R&D, and fulfillment logistics.

They are also closely analyzing sales, brand, and promotion performance (as noted in Figure 2) for specific customers and channels to improve mix profitability and control runaway product proliferation. Uncontrolled proliferation, from continually introducing new product variations, puts food and beverage companies at risk of excessive costs across the organization and inventory write-offs of slow-moving consumable product.

Customer Solutions

Food and beverage companies are catering to a broader spectrum of customers than in the past, when they sold primarily to wholesalers, grocers, food service providers, and food manufacturers. Today they are also selling to end consumers, restaurants, hotels, institutions, vending suppliers, mass merchants, and other types of retailers. Leaders in the industry are expanding their technology and service capabilities to fully address and solve the distinct packaging, product, marketing, and logistics needs of these markets. By doing so, they are shifting their vision from selling agricultural products to providing full-service partially processed food and beverage solutions in specific markets and helping customers promote their products successfully. Although services and turn-key solutions have the allure of higher profit margins, they also carry risks. For example:

- Companies take on more projects than they are equipped to handle

- Unique customer requests disrupt and distract primary businesses

- Employees underestimate effort to meet contract terms

- Management diverts the operational focus away from core strengths

- The high cost of hiring top guns to staff projects hurts margins

- Failing to live up to customer expectations results in financial losses

The industry is moving into uncharted territory, and those that will thrive as market leaders are investing in advanced business systems. These systems give them a continuing pulse of their operating performance in alignment with corporate goals, alert them to project delays or cost overruns, analyze their sales and service profitability by type, and integrate all members of the organization into a cohesive and collaborative body. Market leaders are also strengthening system functionality for R&D, costing, sales, marketing, and customer connectivity to ensure greater accuracy, cost control, customer satisfaction, and profitability (see Figure 2).

Multinational Reach:

Midsized food and beverage processors and distributors have seized growth opportunities and located processing plants and warehousing distribution centers in the U.S. and abroad to expand their operations. They are using the latest technologies and systems to support new product lines, markets, and regions. Most also import or export products to enhance their business reach. As companies in this industry grow, they have greater opportunity to secure strategic relationships with major customers in their target markets who look for growth, modernization, and logistics sophistication.

To minimize the risk of overexpansion and idle operations, prudent companies have taken measures to ensure that growth is coupled with improvements in process efficiencies, asset productivity, operational flexibility, and highly accurate information. They are investing in automated systems and information management infrastructures to share data electronically, seamlessly integrate vertical operations, and support regional and global customers.

Delivering Consistent Product Quality and Reliability

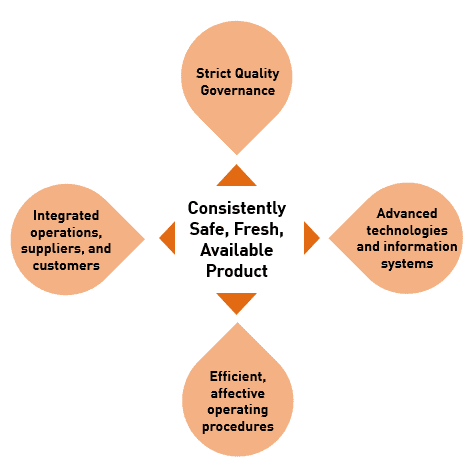

End consumers expect whole and partially processed foods and beverages to be safe, fresh, and continually available regardless of how distant the originating source or what must be done to ensure quality. Food and beverage companies therefore compete on their ability to provide a consistently high yield of blemish-free perishable goods along with superior on-time delivery performance at the lowest cost. Customers may want innovation and full-service solutions, but their business will first go to those that have a track record of reliably meeting product and delivery requirements as promised with the highest quality, minimal returns, and greatest accuracy.

Maintaining and exceeding optimal product quality and delivery while expanding options, markets, and volumes puts many food and beverage companies at risk of stretching the capabilities of their procurement, processing, and logistics operations. Many companies in this industry continually produce and handle millions of pounds of product a week and store

hundreds of thousands of cases or cartons that average 100-200 inventory turns per year. They operate large facilities for inbound storage, processing, packing, packaging, and outbound refrigerated warehousing. When these business units perform inefficiently or ineffectively, they risk lowered margins and profits from product waste, higher operating costs, cross contamination, or unsafe handling.

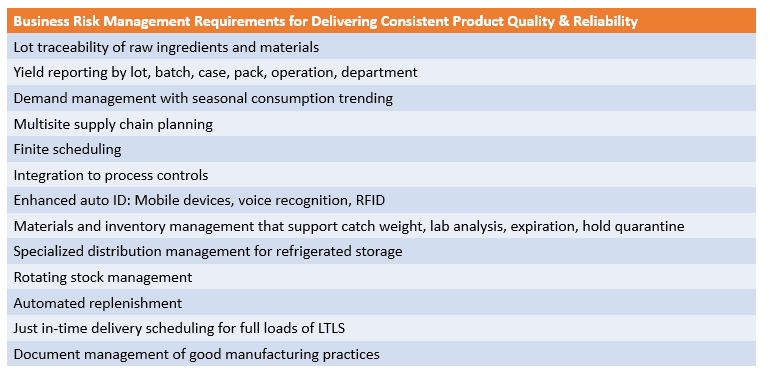

The more savvy operations recognize that quality oversight is integral to their operations, and they continually assess their processes and facilities for potential risks. Producers breed, plant, and harvest select lines under optimal conditions to get maximum growth, minimal waste, and highest predictability. Processors and distributors implement the latest temperature, humidity, and process control technologies to ensure product safety and stability. They also monitor and report on raw material ingredients, processing operations, inventory shelf lives, storage facilities, and anything else that puts food quality, reliability, or safety at risk. They employ current Good Manufacturing Practices (cGMP), Standard Sanitary Operating Procedures (SSOP), and extensive quality assurance systems that include Hazard Analysis and Critical Control Points (HACCP) for food safety. Leaders in this industry continually invest in advanced technologies and information systems to improve their line speeds, quality yields, and operating efficiencies (see Figure 3).

Reliability is just as critical, yet data inaccuracies and poor inventory visibility are common in food and beverage companies even though many are vertically integrated. Sheer volume and multiple moves between operations spread across regions – and increasingly across continents – create opportunities for product loss, information errors, and transit delays. To minimize the risk of supply chain disruptions and customer dissatisfaction, a growing number of companies are turning to enterprise systems that integrate automated process controls with supply chain, warehousing, and fulfillment distribution functions designed for the food and beverage industry, as shown in Figure 4.

Securing Regulatory Compliance and Food Safety

Food and beverage processors and distributors have long been subject to the regulations of the Food and Drug Administration (FDA), United States Department of Agriculture (USDA), and the Environmental Protection Agency (EPA). But that only represents a fraction of the regulatory guidelines most companies are required to uphold to ensure environment, product, and worker safety, as shown in Figure 5. There are dozens of federal, state, and industry agencies that oversee additional regulations and standards compliance for each subsector of the industry. These agencies continue to add more regulations.

Since 9/11, HACCP and the 2002 Bioterrorism Act have received considerable attention and caused a series of product recalls, driving most companies to adopt new practices for food safety and security compliance across their supply chains—from food origin to final destination. Companies have also responded to the 2004 tracking and labeling requirements under the Food Allergen Labeling and Consumer Protection Act (FALCPA) to reduce consumer exposure to harmful bacteria and allergic reactions.

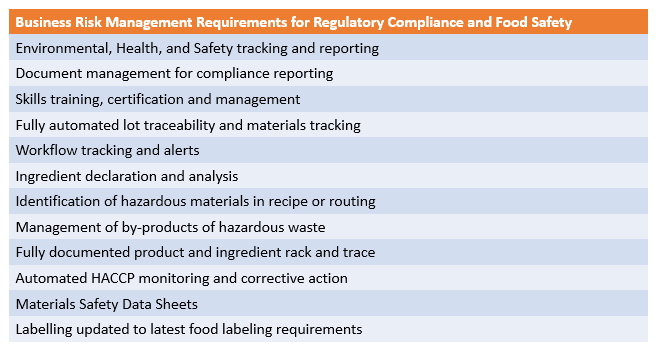

However, many in the industry are at risk for failing to comply with the many regulations, and every month dozens of companies are cited for misconduct and fined for their failure to comply. They risk a massive product recall and corporate loss in market value for their negligence along with stiff fines. Those that take compliance seriously have established corporatewide standardized processes and controls, instituted training programs, beefed up security, and enhanced their systems for full lot and handling traceability, comprehensive recordkeeping, enhanced labeling, document management, and internal audits (see Figure 6).

Many are also integrating Good Agricultural Practices (GAP), cGMP, SSOP, HACCP, and Title 21 Code of Federal Regulations (21 CFR part 11 – for electronic signatures) into a comprehensive internal food safety and intervention program as part of their enterprise business system.

Risk Management in an Expanding Industry

Midsize food and beverage companies are striving to be more things to more markets while ensuring consistent customer satisfaction and regulatory compliance. This isn’t easy under the best of circumstances and demands exacting performance to a carefully orchestrated vision.

Companies that move too fast, stretch their operations too far, or fail to focus on critical success factors risk loss of market share, write-offs, and publicized penalties. This industry is experiencing unprecedented opportunities on a global basis at a time when reliability, quality, and safety are growing concerns. Customers and end-consumers want more options and solutions, and this is driving considerable change in the way products are processed and marketed. Yet the roots of the industry remain unchanged, and too many companies are ill-equipped to oversee all facets of their operations with the scrutiny necessary to mitigate the risks.

The delicate balance between growth and risk avoidance is attained by those that have a solid game plan supported by a comprehensive and flexible enterprise wide system that executes with specified precision. Leaders in the industry have turned to business systems that tightly integrate their vertical operations down to the process controls, extend electronic connectivity to partners, adhere to industry requirements, and adapt to changing business conditions. In doing so they have achieved a competitive advantage that ensures long-term success.